SOVEREIGN WEALTH FUNDS

14th October, 2020

Are you aware that many nations invest in various financial assets in order to make profit for the nation and its citizens? The funds they invest usually comes from the nation’s budgetary surplus and it’s called the Sovereign Wealth Fund (SWF).

This fund is used to ensure the stability of the national economy through diversification (Investing in different assets). This shows that apart from individuals and organizations, even the nations of the world as a whole are seeking ways to build wealth for the future.

Where do Sovereign Wealth Funds invest?

SWFs are some of the world's largest and most sophisticated investors. The top 89 SWFs hold assets worth about USD 8 trillion (SWFI data). These funds typically have one of three primary investment goals - stabilizing government revenues, savings, or local development.

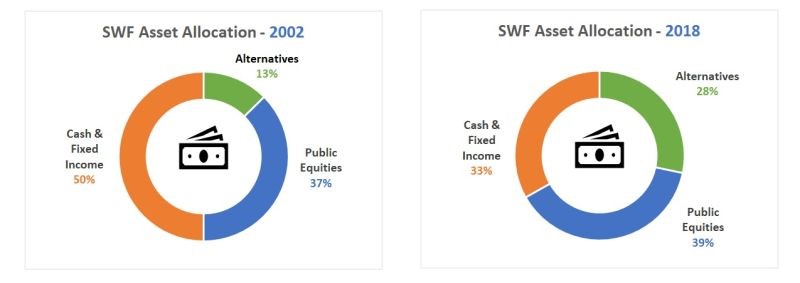

SWFs have gradually shifted their asset allocation strategies since the beginning of the century. Allocation to cash and fixed income back in 2002 used to be as high as 50% when interest rates were much higher and there was a strong preference for steady, recurring returns.

However, cash and fixed income investments have reduced in favor of alternatives (PW, real estate , venture capital), with the latter increasing from 13% to 28% in 2018.

This can be attributed to a number of reasons:

- Reduction in interest rates made acquisition financing cheaper and new bond investments less attractive for recurring returns

- Improving liquidity in PE and real estate markets due to greater prevalence of secondary advisors

- Greater availability of large private market deals, as companies prefer to stay private for longer It will be interesting to see how this trend continues in the post-Covid era, as cash-rich SWFs will eye deals at attractive valuations.