RISK TOLERANCE: HOW DO YOU REACT TO LOSSES

9th November, 2020

Over the last 12 months, the S&P500 index has increased by 8.6%. These would be considered impressive returns by a passive investor in any given year, and especially so in 2020. However, investors tracking the market would feel much less cheerful, knowing that the index is down 7.7% since its high in September.

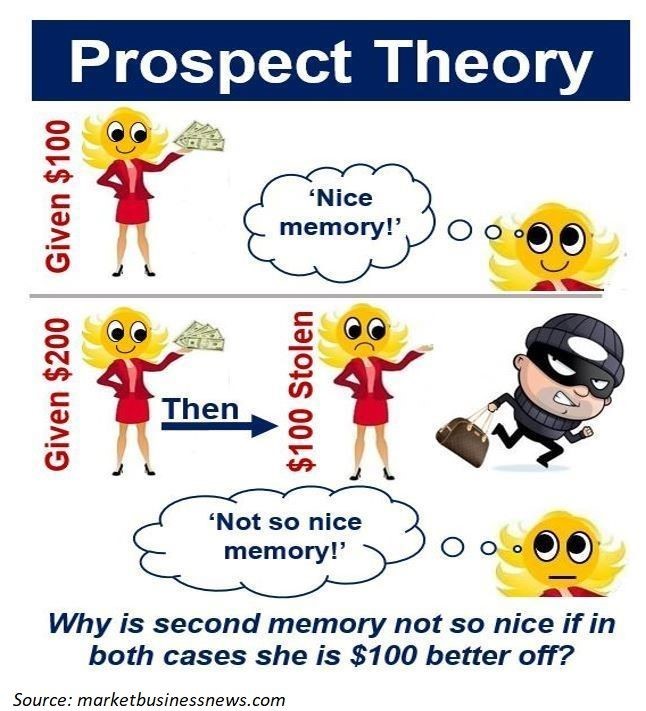

This difference in sentiment over the same net returns is explained by Prospect Theory, developed by Daniel Kahneman and Amos Tversky (1979). According to Prospect Theory, investors process gains and losses differently, not acting rationally.

Consider the following two scenarios:

- 1. You have been given $200. You are now asked to choose between:

a. A sure gain of $100

b. A 50% chance to gain $200 and a 50% chance to gain nothing - 2. You have been given $400. You are now asked to choose between:

a. A sure loss of $100

b. A 50% chance to lose $200 and a 50% chance to lose nothing

Average investors (moderate risk) would take a sure gain in the 1st scenario but take a chance to avoid loss in the 2nd scenario - loss aversion). Therefore, in managing our portfolios, it is important to view our risk tolerance by assessing our behavior in both gain and loss scenarios.

Why do you need to know your risk tolerance level?

Investing shouldn't steal your peace of mind. If you are unable to sleep at night because of your investment portfolio then it's obvious some things need to be corrected.

Your portfolio should be created based on your income, your financial goal, your time horizon, and your risk tolerance level.

If you don't react so well to losses then your tolerance level is low and you need to invest conservatively.

Another reason why you must assess your risk tolerance level is that if you don't do great at handling a specific level of loss, chances are high that you will make a wrong decision out of panic when the market doesn't go in your favor.

This will make the situation worse.

Having a low-risk tolerance level isn't bad, it's alright to start with low-risk investments and grow into being comfortable with taking higher risks with time.