Diversification: The Best Approach to Long-term Personal Investment.

16th September, 2020

It’s tempting to think about how well we would have done if we had just held tech stocks (AMZN, AAPL, FB, MSFT) over the last decade. Indeed, it became one of the most popular topics on social media and conversations with friends, as Apple crossed the US$ 2T market cap. However, that's not the best approach to long-term personal investing.

Tech stocks did great, but can you do better?

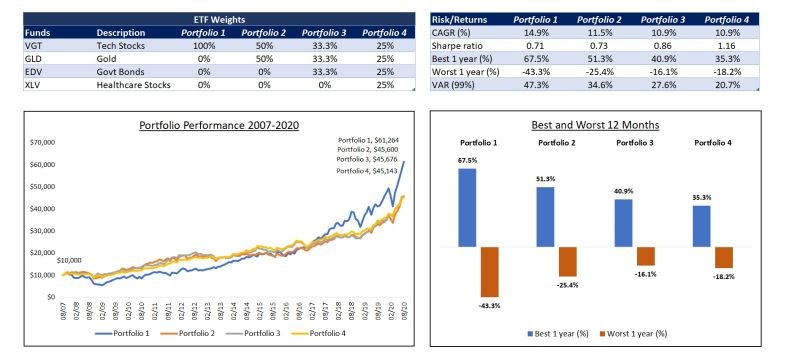

Below is an illustration of risk and returns during the 2007-20 period (covering two crises) in different ETF portfolio diversification scenarios:

- 1. 100% tech stocks

- 2. 50% each in tech stocks and gold

- 3. 33% each in tech stocks, gold, and government bonds

- 4. 25% each in tech stocks, gold, government bonds, and healthcare stocks

Note the following trends in risk and return profile as diversification is increased:

- 1. CAGR decreases for sure, but VAR (volatility) decreases much more sharply

- 2. Portfolio best/worst range becomes much narrower

- 3. 33% each in tech stocks, gold, and government bonds

- 3. Sharpe ratio (risk-adjusted return measure) improves substantially

Which portfolio would you rather hold for your personal investments?