Have You Adopted a Fintech Solution?

25th, July 2020

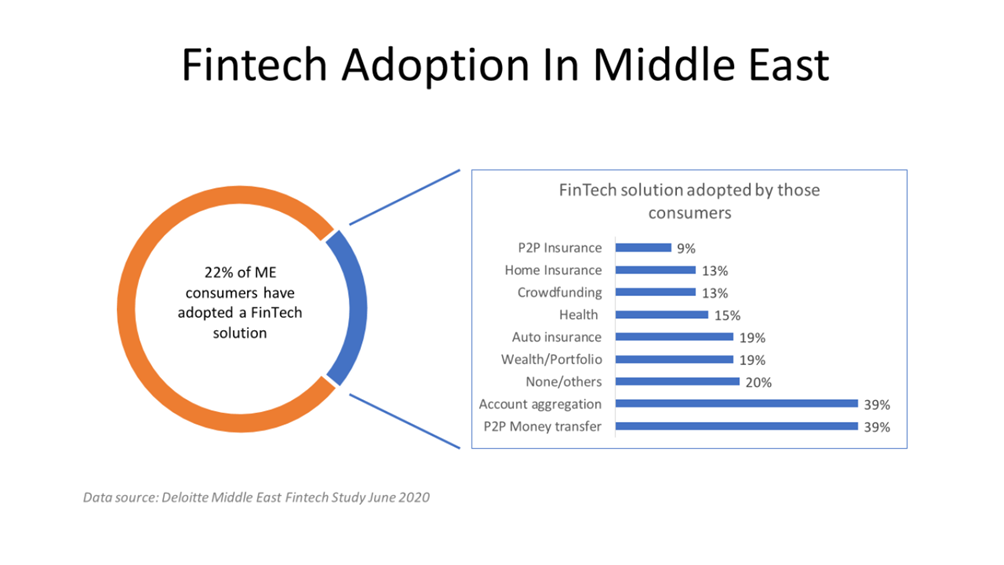

According to recent studies, only about 22% of Middle East banking consumers have adopted a FinTech solution so far for their banking and financial needs. This does not include a large portion of the population that is unbanked.

Among this 22% of consumers, the most popular solutions are money transfers (including payments) and account aggregation (such as online banking). Each of these has been tried by 39% of the FinTech adopters, and these categories are still dominated by incumbent banks and exchange houses.

This reflects a relatively low rate of penetration for a wide variety of services that can be provided by FinTech startups, such as insurance, lending, and wealth management. This also highlights massive room to grow for FinTech solutions, given that over 70% of the Middle East population has internet access (close to 100% in GCC).

The below factors play a role in lowering FinTech adoption:

1. Banks have shown keenness in exploring Fintech partnerships, but have not moved fast enough in collaborating with startups. Founders often point to long lead times in pitching tech solutions to banks.

2. API-based infra is relatively new among regional banks, making it harder to collaborate with Fintechs.

3. Funding available for innovative regional Fintech startups is still low outside of UAE and KSA.

4. Lack of Sharia-compliant Fintech solutions (bigger problem outside GCC) affects adoption rates

Which of these FinTech solutions do you use regularly? Which are the other financial services ripe for FinTech disruption in your opinion?