THE SHIFT TOWARDS DIVERSIFICATION

18th september, 2020

A boring diversified portfolio helps you sleep better in shaky markets.

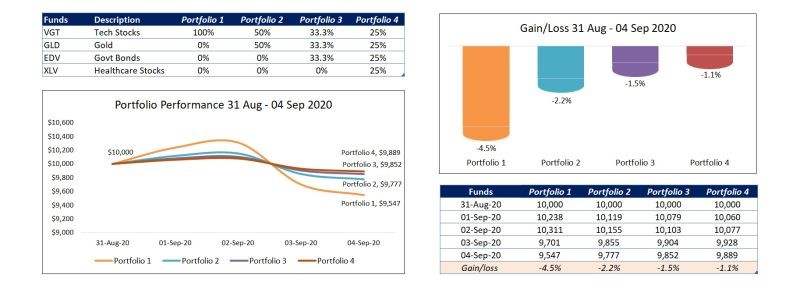

A few days ago we posted about four portfolio scenarios (Hyperlink to post 8) and why a diversified portfolio may provide a better risk/return profile by reducing volatility, even at the cost of slightly lower returns.

Since then, markets have undergone a much needed (albeit sharp) correction, led by tech stocks.

The below charts illustrate the new performance of the same four portfolios (different levels of diversification). The most diversified portfolio saw the lowest level of losses over the last 5 days.

Of course, 5 days is not enough time to assess a portfolio from a long-term perspective, but the benefits of diversification are well researched and time-tested.