Effect of Covid-19 on Discounted Cashflow (DCF) Valuations

30th October, 2020

Covid-19 has caused a double whammy for DCF valuations.

Analysts have reduced earning projections not only for 2020, but also the next 3 to 5 years for most sectors, with a few exceptions such as tech and healthcare. This will certainly reduce discounted cashflow (DCF) valuations of companies, which weigh near-term future cash flows more heavily than long-term.

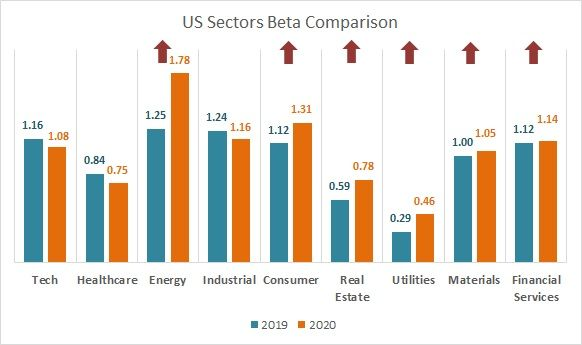

It gets worse with a rising denominator, as cost of capital estimates rise owing to a higher Beta (measure of a stock's volatility relative to the market). The chart below illustrates how betas for US companies have risen across most sectors in 2020, compared to last year.

(Data source: Yahoo Finance)

Potential counter-measures in DCF calculations:

- Risk free rates have fallen slightly. However, equity risk premia may increase.

- Capital expenditure may be reduced by companies in the near term, though excessive reduction will have a negative impact on earnings in the long run

- Slightly lower cost of debt

PS: Analysts should take caution while sourcing Beta estimates, as pre-Covid figures may be outdated.